MARA Stock Forecast: Analyzing the Future of Marathon Digital Holdings?

Introduction

Marathon Digital Holdings (NASDAQ: MARA) is one of the most prominent cryptocurrency mining companies in the world. As Bitcoin continues to gain traction, MARA stock has seen significant price fluctuations, drawing interest from investors. This article provides a comprehensive MARA stock forecast, analyzing past performance, current trends, and future predictions based on expert insights and market analysis.

Overview of Marathon Digital Holdings

Marathon Digital Holdings focuses on mining Bitcoin, a process that involves validating transactions on the blockchain network. With Bitcoin prices fluctuating, the performance of MARA stock is closely tied to the cryptocurrency market.

Key Details About MARA Stock

- Stock Ticker: NASDAQ: MARA

- Industry: Cryptocurrency Mining

- Market Cap: Varies based on Bitcoin trends

- Recent Stock Price: $14.76 (as of March 2025)

- 52-Week Range: Varies widely due to crypto market volatility

MARA Stock Performance in 2024-2025

Marathon Digital has experienced significant volatility, driven by Bitcoin’s price action and regulatory developments in the cryptocurrency industry. Some key performance indicators include:

- Q3 2024 Revenue Growth: Marathon Digital reported a 35% increase in revenue, reaching $131.6 million.

- Bitcoin Mined: The company mined 2,070 bitcoins in Q3 2024.

- Stock Movement: Over the past year, MARA stock has fluctuated between $13 and $30 per share.

Factors Influencing MARA Stock Performance

Several factors play a crucial role in determining the price movement of MARA stock:

- Bitcoin Price Trends

- As a Bitcoin mining company, Marathon Digital’s stock performance is directly linked to Bitcoin’s price. Higher Bitcoin prices lead to increased profitability for MARA.

- Regulatory Environment

- Changes in cryptocurrency regulations can significantly impact Marathon Digital’s operations and profitability.

- Energy Costs & Mining Efficiency

- The cost of electricity and advancements in mining technology affect the company’s profitability and competitive advantage.

- Institutional Investment

- Growing institutional interest in Bitcoin and blockchain technology may drive more investments into companies like Marathon Digital.

MARA Stock Forecast for 2025 and Beyond

Analyst Predictions

Financial analysts have provided various price targets for MARA stock, reflecting its high volatility:

- Average Price Target: $23.86

- Bullish Estimate: $30.00

- Bearish Estimate: $14.00

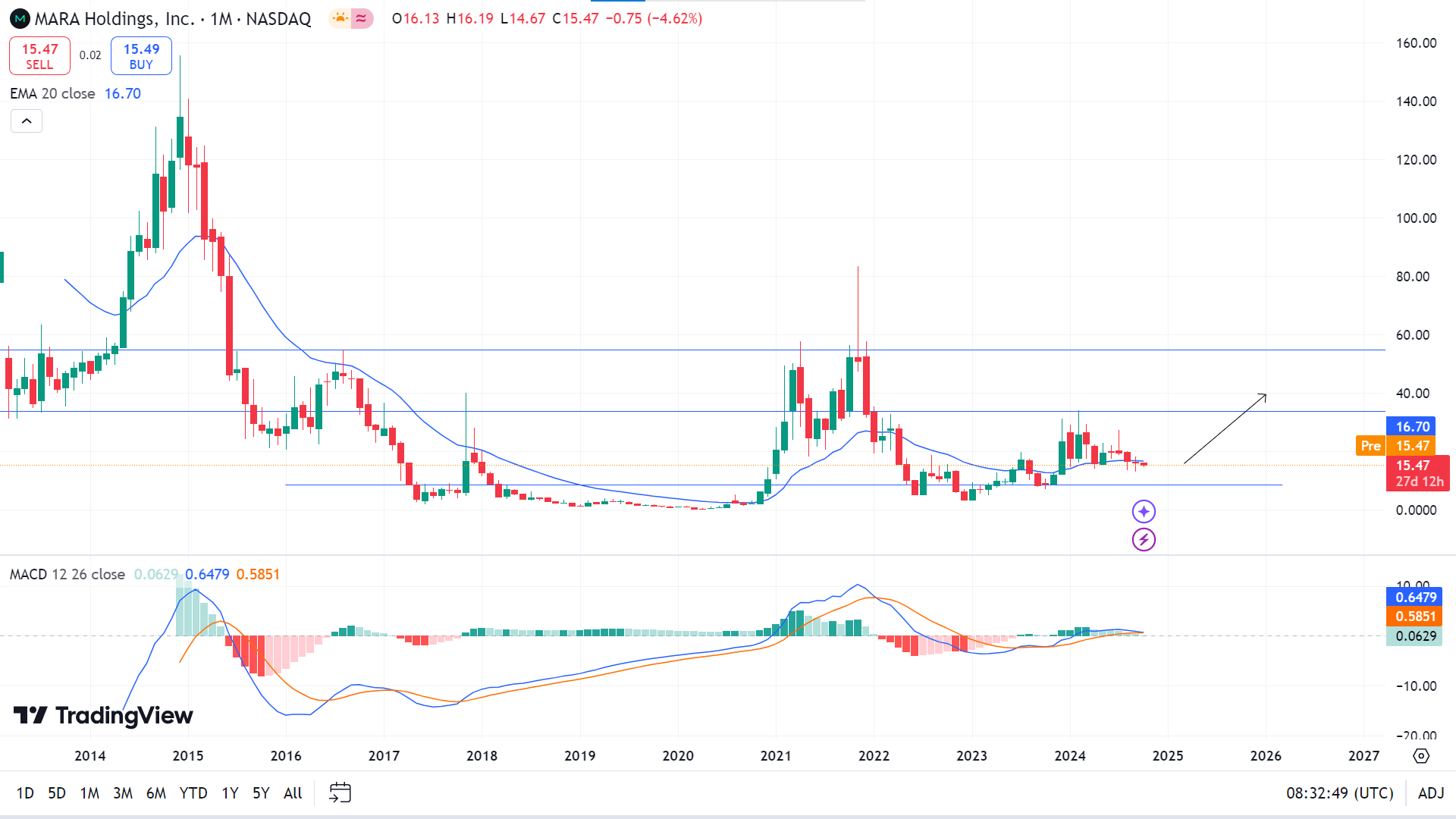

Technical Analysis

MARA stock has shown strong resistance and support levels:

- Resistance Level: Around $28-$30

- Support Level: Around $12-$14

Should You Invest in MARA Stock?

Investing in MARA stock carries both potential rewards and risks:

Pros of Investing in MARA Stock

- Strong Correlation with Bitcoin Growth: If Bitcoin prices rise, MARA stock is likely to follow.

- Expanding Mining Operations: Marathon Digital continues to increase its mining capacity, improving future revenue potential.

- Institutional Support: Increased institutional interest in Bitcoin may drive further investments in MARA.

Cons of Investing in MARA Stock

- High Volatility: Cryptocurrency stocks, including MARA, are highly volatile.

- Regulatory Uncertainty: Changes in government policies can impact mining operations.

- Operational Costs: Rising energy prices can affect profitability.

Final Thoughts on MARA Stock Forecast

MARA stock remains a high-risk, high-reward investment option. Investors should closely monitor Bitcoin price trends, regulatory changes, and Marathon Digital’s expansion plans before making investment decisions. With expert predictions suggesting potential growth, MARA stock may be a strong choice for investors with a high-risk tolerance.

You may also read: Foster at CryptoProNetwork: A Key Player in the Blockchain Revolution?